An Initial Public Offering (IPO) is a significant event in the life of any company. It marks the transition from a private entity to a publicly traded company on a stock exchange, providing access to capital and increasing the company’s visibility in the marketplace. IPOs represent an opportunity for investors to buy shares in companies at the beginning of their journey as public entities. For investors, IPOs present opportunities to profit from growth potential but come with inherent risks and challenges. Understanding the IPO process, its benefits, risks, and the investment opportunities it creates is essential for making informed decisions.

In this article, we will explore the IPO public offering process, the opportunities it presents for investors, key risks to consider, and the important steps involved. Additionally, we will answer common questions and provide practical insights for those looking to navigate the IPO market effectively.

Key Takeaways

- An IPO is the process by which a private company offers its shares to the public for the first time.

- IPOs provide investors with an opportunity to access high-growth companies at an early stage.

- The IPO process involves several steps, including selecting underwriters, filing with the SEC, conducting a roadshow, and pricing the offering.

- While IPOs offer the potential for high returns, they also come with significant risks, such as price volatility and overvaluation.

- Thorough research and an understanding of the company’s financial health and industry prospects are essential when considering IPO investments.

What is an IPO Public Offering ?

An Initial Public Offering (IPO) is the process by which a privately held company offers its shares to the public for the first time. By listing on a stock exchange, the company becomes a publicly traded entity. IPOs allow the company to raise capital by selling a portion of its ownership to public investors. As a result, the company gains access to capital that can be used for business expansion, debt reduction, or other strategic initiatives.

An IPO is typically the result of years of preparation, during which the company positions itself for public scrutiny. It can involve intense scrutiny from investors, regulators, and the market, as the company must disclose detailed financial information and future projections.

Why Do Companies Choose to Go Public?

There are several reasons why a company might decide to go public through an IPO:

- Raising Capital: The primary reason for an IPO is to raise capital for expansion, acquisitions, or working capital. Companies often need additional funds to fuel growth, research and development, or to pay down debt.

- Public Exposure and Credibility: Going public can increase a company’s visibility in the marketplace. It enhances brand recognition, attracts new customers, and establishes credibility.

- Exit Strategy for Early Investors: For venture capitalists and private equity investors, an IPO offers an exit strategy to sell shares and realize their return on investment. It provides liquidity for initial investors.

- Employee Incentives: Publicly traded companies can offer stock options as part of their compensation packages, which can help attract and retain top talent.

- Mergers and Acquisitions: Public companies can use their shares as currency in mergers or acquisitions, providing more flexibility in strategic growth.

The IPO Process: A Step-by-Step Breakdown

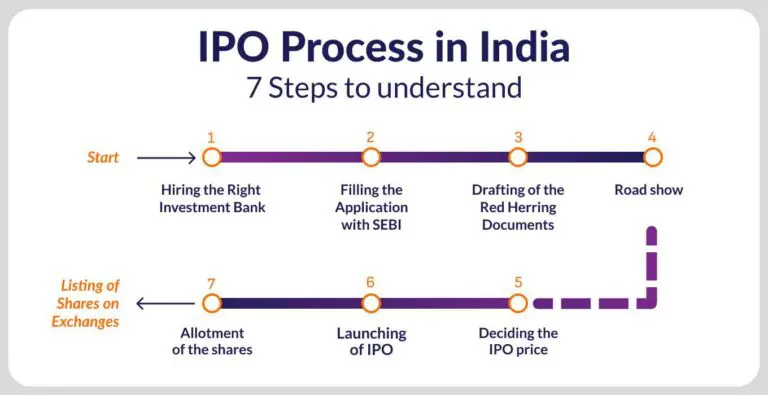

The IPO process is complex and involves several critical stages that require coordination between the company, underwriters, regulators, and investors. The process typically spans several months and involves the following steps:

a. Pre-IPO Planning

The process begins with the company’s decision to go public. This stage involves selecting the right financial advisors and investment banks (underwriters) to help guide the IPO. These advisors assist with financial modeling, pricing, and understanding the capital market conditions.

During this phase, the company evaluates its readiness to become public, considering factors such as financial stability, management structure, and business growth prospects. The company may also decide to restructure its operations and improve its financial transparency to meet the reporting requirements of a public company.

b. Selecting Underwriters

Underwriters are financial institutions (typically investment banks) that help manage the IPO process. The underwriters assist the company in setting the price range for the IPO shares, determining how many shares to issue, and handling the sale of shares to investors. These institutions are critical in assessing the company’s marketability and determining the valuation that will appeal to investors.

Underwriters also provide a guarantee that they will purchase any unsold shares during the offering, which can protect the company from being under-subscribed.

c. Filing with the SEC

Once the underwriters are in place, the company must file a registration statement with the Securities and Exchange Commission (SEC), which is the U.S. regulatory body responsible for overseeing securities transactions. The most common document filed is Form S-1, which provides an in-depth look at the company’s financials, business model, risks, and plans for the future.

The SEC reviews this document to ensure that the company has provided all the necessary information for potential investors. This includes details about the company’s operations, management, financial statements, and other disclosures. During this review process, the SEC may request revisions to the filing to ensure transparency and clarity.

d. Roadshow

Once the SEC approves the registration statement, the company and its underwriters begin the “roadshow,” a marketing campaign designed to generate interest from institutional investors such as pension funds, mutual funds, and hedge funds. The roadshow involves presentations by the company’s executives and underwriters, who explain the company’s business model, financial prospects, and vision for the future.

The roadshow is crucial in gauging the market demand for the IPO and getting feedback from potential investors. It also helps determine the final price range for the shares. In addition to institutional investors, some IPOs allow retail investors to participate, though this depends on the broker’s access to the offering.

e. Pricing the IPO

After the roadshow concludes, the underwriters work with the company to set a final offering price and determine the number of shares to be issued. This price is based on investor demand during the roadshow, market conditions, and the company’s financial health. The final price is critical because it determines the amount of capital the company will raise and how the stock will perform on its first day of trading.

Typically, the company and its underwriters aim to strike a balance between pricing the shares low enough to generate investor interest and high enough to achieve the capital raise the company needs.

f. The IPO Launch

Once the offering price has been set, the company’s shares are listed on a stock exchange such as the New York Stock Exchange (NYSE) or NASDAQ. At this stage, the company becomes a publicly traded entity, and its shares are available for purchase by investors. The stock begins to trade on the open market, and the company receives the proceeds from the sale, which will be used for various corporate purposes.

g. Post-IPO Trading and Lock-Up Period

After the IPO, there is usually a lock-up period that lasts between 90 and 180 days. During this period, insiders, such as company executives, employees, and early investors, are prohibited from selling their shares. This restriction helps prevent a flood of shares hitting the market immediately after the IPO, which could negatively affect the stock price.

Once the lock-up period expires, insiders may sell their shares, which could cause volatility in the stock price as supply and demand dynamics shift. Investors need to monitor the market during this period, as selling pressure can affect the stock price.

Opportunities in IPO Investments

IPOs offer investors the chance to access growth opportunities that may not be available through traditional public market investments. Below are some of the key opportunities IPOs provide for investors:

a. Access to High-Growth Companies

IPOs provide an opportunity to invest in companies that are at the beginning of their public trading journey. Many IPOs come from industries experiencing rapid growth, such as technology, biotech, or renewable energy. By investing early, investors can gain access to high-growth companies that could significantly appreciate in value as they expand and mature in the public market.

b. Potential for High Returns

Investing in an IPO can provide early investors with significant returns, particularly when the company experiences strong growth after the offering. Many IPO stocks experience a sharp rise in price shortly after they begin trading, providing early investors with the potential for substantial profits. In some cases, IPO investors have seen returns of over 100% in the first day of trading.

c. Diversification of Investment Portfolio

IPOs offer investors the chance to diversify their portfolios by investing in emerging industries or companies that are not yet part of their existing stock holdings. This diversification can help reduce overall portfolio risk by introducing exposure to different sectors or industries with different risk/reward profiles.

d. Early Access to Promising Startups

Investors who participate in an IPO often get access to promising companies at an early stage, before they become well-established in the public markets. This early access to promising startups or growth companies gives investors the chance to benefit from the company’s long-term potential.

Risks of Investing in IPOs

While IPOs present opportunities, they also come with risks that investors need to be aware of:

a. Volatility and Price Fluctuations

IPOs are often volatile in the days and weeks following their debut on the stock market. It is common for IPO stocks to experience significant price swings, which can be difficult for investors to predict. Many factors, such as market sentiment, investor demand, and the company’s post-IPO performance, can influence the price in the short term.

b. Overvaluation Risk

Some IPOs are priced based on optimistic projections, which may lead to overvaluation. A company’s stock price could be inflated due to hype or investor excitement, and it may not be sustainable in the long term. Overvalued IPO stocks are more likely to experience a price correction, causing investors to lose money.

c. Limited Historical Data

When investing in an IPO, investors are often basing their decisions on limited historical data. The company may not have a long track record of financial performance, and its growth projections may be speculative. Investors must carefully assess whether the company can meet these projections and whether its business model is sustainable in the long term.

d. Insider Selling Pressure

Once the lock-up period expires, insiders such as executives and early investors are allowed to sell their shares. This can lead to selling pressure that drives the stock price down, especially if insiders sell large quantities of shares. Investors should be aware of the lock-up period expiration and monitor the stock for signs of insider selling.

Also Read: Navigating Ipo Investments: How To Make Smart Decisions In New Offerings

Conclusion

IPOs offer a unique opportunity for investors to gain early access to high-growth companies. However, they also come with inherent risks, including volatility, overvaluation, and uncertainty. Understanding the IPO process, evaluating the company’s financials and prospects, and being aware of the risks involved can help investors make informed decisions when considering IPO investments.

For companies, an IPO provides a significant opportunity to raise capital, enhance visibility, and achieve business growth. However, it also brings challenges, such as regulatory scrutiny, market volatility, and the responsibility of meeting investor expectations.

FAQs

What is the difference between an IPO and a direct listing?

An IPO involves the company issuing new shares to raise capital, while a direct listing allows existing shareholders to sell their shares without issuing new ones. Direct listings do not raise capital for the company, but they provide liquidity to existing investors.

Can I invest in an IPO as a retail investor?

Yes, retail investors can invest in IPOs, but they may need to meet certain eligibility criteria and go through their brokerage accounts. In some cases, retail investors may not have access to IPO shares if demand exceeds supply.

How can I assess if an IPO is a good investment?

To assess an IPO, investors should evaluate the company’s financial health, industry prospects, valuation, management team, and risk factors. It’s also essential to consider the offering price and whether the company’s growth projections are realistic.

Are IPOs safe investments?

IPOs are generally considered higher-risk investments due to their volatility and lack of historical performance data. While they offer the potential for high returns, they also carry the risk of significant losses.

What is a lock-up period?

A lock-up period is a period of time (usually 90 to 180 days) after the IPO during which insiders (company executives, employees, and early investors) are prohibited from selling their shares.

Can IPOs go down after the first day of trading?

Yes, IPO stocks can go down after their debut on the stock market. While some IPOs experience price increases, others may face price corrections or declines due to various factors, such as market sentiment or poor post-IPO performance.

Should I invest in an IPO immediately?

Investing in an IPO immediately can be risky due to early price volatility. Many investors prefer to wait for the stock to stabilize after the initial trading days before making a decision.